Introduction

Corporate mergers are a significant part of the business landscape, involving the combination of two or more companies into one entity. These mergers can offer opportunities for growth, increased market share, and enhanced operational efficiencies. However, they also come with challenges that require careful planning, due diligence, and execution. In this article, we’ll explore what https://www.inova-vox.com are, the types of mergers, the process involved, and best practices for successfully navigating a merger.

What are Corporate Mergers?

A corporate merger occurs when two companies decide to combine their operations, assets, and management under a single entity. This process can help businesses grow in scale, expand their market presence, reduce competition, or leverage synergies to improve profitability. Mergers can be motivated by a variety of factors, including the desire to increase market share, diversify product offerings, enter new markets, or achieve cost savings.

While mergers often involve significant strategic benefits, they require careful planning to ensure that the integration of two distinct organizations is smooth and successful.

Types of Corporate Mergers

Mergers can take various forms depending on the relationship between the merging companies. The main types of corporate mergers include:

-

Horizontal Merger

A horizontal merger occurs when two companies that operate in the same industry and are direct competitors combine their operations. This type of merger aims to increase market share, reduce competition, and achieve economies of scale. For example, two smartphone manufacturers merging to dominate the market. -

Vertical Merger

In a vertical merger, companies that operate at different stages of the supply chain within the same industry combine. This merger aims to streamline operations, reduce costs, and secure a reliable supply of raw materials or distribution channels. For example, a car manufacturer merging with a parts supplier. -

Conglomerate Merger

A conglomerate merger occurs when two companies from unrelated industries merge. This type of merger aims to diversify the companies’ portfolios, reduce risk, and enter new markets. For instance, a tech company merging with a food manufacturer. -

Market Extension Merger

A market extension merger happens when two companies that sell the same products or services in different markets (geographically or demographically) merge. This merger helps both companies access new customer bases and expand their market reach. -

Product Extension Merger

A product extension merger involves two companies that sell different but related products within the same market. The aim is to diversify product offerings and offer a broader range of options to consumers.

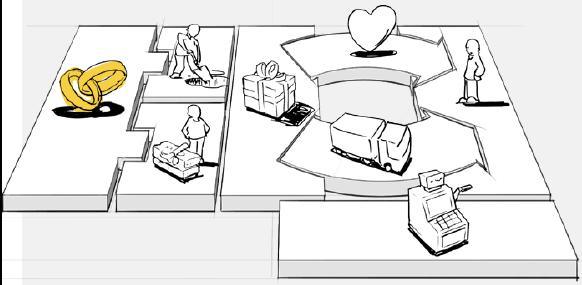

The Merger Process

The process of a corporate merger involves several stages, from initial negotiations to post-merger integration. Below is an outline of the typical steps involved in a merger:

-

Strategic Planning and Decision-Making

The merger process begins with strategic planning. The companies involved will assess their reasons for merging and ensure that the merger aligns with their long-term goals. This stage may involve identifying potential merger candidates, conducting initial research, and analyzing financial and operational compatibility. -

Due Diligence

Due diligence is a critical phase in the merger process. During this stage, the companies conduct a thorough investigation of each other’s financial health, assets, liabilities, legal matters, intellectual property, and potential risks. The goal is to identify any issues that might impact the merger or integration process. It helps mitigate the risk of surprises and ensures both parties are fully aware of the strengths and weaknesses of the other organization. -

Negotiation and Agreement

Once due diligence is completed, the next step is to negotiate the terms of the merger. This includes the valuation of both companies, the structure of the deal, and the exchange of ownership stakes. Lawyers, accountants, and other advisors are typically involved in this phase to ensure that all legal and financial aspects are properly addressed. The result of this negotiation is a merger agreement, which lays out the specific terms, timeline, and conditions of the merger. -

Approval and Regulatory Compliance

Depending on the size of the companies involved, regulatory approval may be required before the merger can proceed. Regulatory bodies, such as antitrust authorities, review the deal to ensure it doesn’t violate competition laws or create a monopoly. Companies may need to submit filings and provide additional documentation to comply with legal requirements. -

Post-Merger Integration

After the merger is officially completed, the most challenging phase begins: post-merger integration. This phase involves combining the operations, cultures, and systems of the two companies. The integration process can involve aligning business processes, streamlining operations, consolidating teams, and managing cultural differences. Successful integration is crucial to realizing the potential benefits of the merger, such as cost savings, increased market share, and enhanced capabilities.

Benefits of Corporate Mergers

-

Increased Market Share

Mergers allow companies to combine their market presence, leading to a larger customer base, more brand recognition, and greater competitive advantage in the market. With more resources, merged companies can also negotiate better deals with suppliers and improve pricing. -

Cost Savings and Economies of Scale

One of the most significant advantages of a merger is the potential for cost savings. By consolidating operations, eliminating duplicate functions, and leveraging larger scale, companies can achieve efficiencies that reduce costs across various areas of the business, including production, marketing, and administration. -

Access to New Markets

Mergers allow companies to expand into new markets, whether geographically or demographically. By combining forces with another company, businesses can enter new regions, diversify their customer base, and offer additional products and services. -

Increased Resources and Capabilities

Merging companies often gain access to new technologies, intellectual property, and talent pools. This can increase their innovation capacity and give them a competitive edge in developing new products and services. -

Diversification

By merging with a company in a different industry, businesses can diversify their operations and reduce their dependence on a single market. This helps spread risk and increase financial stability in the long run.

Challenges and Risks of Corporate Mergers

-

Cultural Differences

Cultural clashes between the merging organizations can create friction among employees and management. Differences in company values, work styles, and communication practices can hinder collaboration and productivity. It’s essential to manage cultural integration thoughtfully to avoid alienating employees and creating morale problems. -

Integration Difficulties

Merging two companies requires extensive planning and coordination. Integrating systems, operations, and staff can be complex and time-consuming. Without careful attention to detail, the process can result in operational disruptions, inefficiencies, and lost opportunities. -

Regulatory Hurdles

Regulatory bodies closely scrutinize corporate mergers, especially when large companies are involved. Antitrust issues and competition concerns can lead to delays, restructuring requirements, or even the blocking of the merger. Companies must navigate these regulatory challenges carefully to ensure compliance. -

Overestimated Synergies

Sometimes, companies overestimate the synergies (i.e., the expected benefits) of a merger. If the anticipated cost savings, increased revenues, or operational efficiencies do not materialize as expected, the merger may fail to deliver the desired results. -

Employee Uncertainty

Mergers can create uncertainty among employees, leading to anxiety about job security, role changes, or relocation. Clear communication, employee support programs, and transparency are key to mitigating this risk and maintaining morale during the transition.

Best Practices for Successful Mergers

-

Conduct Thorough Due Diligence

Comprehensive due diligence is essential to identify potential risks and ensure the merger is a sound decision. This process should cover financial health, legal matters, operational processes, and cultural compatibility. -

Communicate Transparently

Clear communication is crucial to ensuring that employees, customers, and stakeholders understand the rationale for the merger and what to expect. Transparent communication helps reduce anxiety and build trust throughout the process. -

Develop a Detailed Integration Plan

A well-thought-out integration plan is essential for merging operations, technologies, and teams. This plan should include timelines, roles and responsibilities, and specific objectives to ensure a smooth transition. -

Focus on Cultural Integration

Managing cultural differences between the merging companies is critical to the success of the merger. Invest time in aligning corporate values, fostering teamwork, and maintaining employee morale to avoid cultural clashes. -

Monitor and Adapt

After the merger is completed, continue monitoring progress and adjust the integration plan as needed. Regular reviews help identify issues early and allow for corrective action to be taken.

Conclusion

Corporate mergers can be powerful tools for growth, expansion, and efficiency. However, they require careful planning, thorough due diligence, and effective integration strategies to succeed. By understanding the different types of mergers, the steps involved, and the potential challenges and benefits, companies can increase the likelihood of a successful merger that drives long-term value for all stakeholders involved.